Add behavioural insights to your counter fraud toolbox

We usually design policies and programs based on the expectation that others (such as program participants) will act in a rational way. But in reality, we often behave in ways that don’t seem completely rational – our choices are shaped and constrained by our past experiences, our wants and needs, and our environment. Understanding all these drivers helps us to encourage desired behaviours, such as compliance with program rules and obligations.

This is the study of behavioural insights – exploring how people make decisions and what impacts their behaviour. When used effectively, this can be a powerful tool to supercharge your counter fraud activities.

The following tools can help you start exploring and understanding the behaviour of people who may be vulnerable to committing fraud:

- the Fraud Triangle

- Fraudster Personas

- fraud case studies.

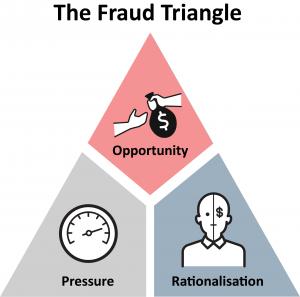

The Fraud Triangle

Your first tool is the Fraud Triangle. Use it to evaluate where your program may be defrauded. Think about how a person would have the:

- opportunity to commit fraud

- ability to rationalise committing fraud

- pressures on them to need to commit fraud.

For example, think how a person would rationalise a decision to supply false information about their circumstances to apply for a government payment. They may think:

- “I'm not hurting anyone”

- “other people are doing the same thing”

- “no one will catch me”.

You can counter this mindset through communications that make it harder for a person to rationalise their decision. For example, you might communicate:

- the strength of your system to identify such fraud to highlight the likelihood they will be caught

- that most people do the right thing because social norms often guide behaviour

- that fraud reduces the program's ability to provide much needed support to the community.

Fraudster Personas

Another great tool is our Fraudster Personas, which provide a foundation to understanding the different methods and behaviours people apply when they commit fraud. Use these as a starting point to give you a good understanding of how a person may try to commit fraud against your program, and to explore ways to deter those behaviours.

For example, you may identify Fabricators are making claims using fabricated documents. By understanding their behaviour, you can identify opportunities to combat them up‑front to avoid receiving fabricated documents in the first place (and avoid a costly investigation). For example, you might:

- add visual imagery to forms, such as verification tick, to illustrate that information will be checked and verified to deter fraudsters through the increased perception of being caught

- warn users of the consequences of supplying incorrect information at the start of a process rather than at the end when they may have already created the false document and it's less likely to be acted on

- inform users their supporting documentation will be sourced from a reliable and independent third party to discourage unqualified applicants from applying, such as by obtaining evidence of studies or qualifications directly from the education provider.

Case studies

A third tool is our case studies register with dozens of examples of how people commit fraud. Case studies are great for illustrating how, but also why, people commit fraud. Learning from these examples will help you implement measures to deter similar types of fraud against your program.

For example, insider sells client identity information to criminals demonstrates why they committed fraud (they were coerced) and how they did it (they sent text messages with the information). Entities who handle sensitive or personal information can use this case study to identify opportunities to discourage similar behaviours through:

- training and supporting staff to deal with a situation where a person tries to pressure them to commit fraud

- introducing signage around the use of mobile phones in secure areas to encourage a security aware culture and increase the perceived risk of being caught

- installing system prompts that alert the user that unauthorised access to client information is investigated to combat the rationalisation to commit fraud.

Share your examples

Has your entity explored the behaviour of fraudsters? Have you introduced countermeasures aimed at the behaviour of potential fraudsters? Share your examples with us through the contact us form to help inform our future guidance document.

Further information

The Fraud Messaging Toolkit provides messages that are designed to communicate the likelihood that someone will be caught if they commit fraud and the consequences of being caught. This works to change a person's beliefs about the situation, risks and benefits, resulting in deterring them from committing fraud.

The Behavioural Economics Team of the Australian Government, within the Department of the Prime Minister and Cabinet, is dedicated to helping Australian Government entities apply behavioural insights to public policy and administration to advance the wellbeing of Australians.

The UK Behavioural Insights Team’s applying behavioural insights to reduce fraud, error and debt paper is an excellent tool to understand some basic measures you can put in place to start using behavioural insights to your advantage.

Author: Sam Eaton