Learn about the Fraud and Corruption Control Framework

A new Commonwealth Fraud and Corruption Control Framework came into effect on 1 July 2024.

The Commonwealth Fraud and Corruption Control Framework 2024 is designed to support Australian Government entities to effectively manage the risks of fraud and corruption.

The changes to the framework form part of the government’s integrity reforms to improve the standards of integrity across the public sector and trust in government.

About the framework#

Purpose

The purpose of the framework is to support an effective system of governance and accountability across Commonwealth entities for protecting public resources from fraud and corruption.

The framework establishes the key elements entities require for effective fraud and corruption control. These are:

- governance and oversight

- rigorous risk assessments

- informed and targeted control plans

- effective controls encompassing appropriate prevention, detection, investigation, referral and reporting mechanisms.

Elements of the framework

The framework consists of 3 parts:

- Fraud and Corruption Rule (Section 10 of the Public Governance, Performance and Accountability (PGPA) Rule 2014) provides the legislative basis for the Commonwealth’s fraud and corruption control arrangements.

- Fraud and Corruption Policy sets out the key procedural requirements for accountable authorities of non-corporate Commonwealth entities (NCEs) to establish and maintain an appropriate system of fraud and corruption control for their entity.

- Fraud and Corruption Guidance (Resource Management Guide 201 - Preventing, detecting and dealing with fraud and corruption) provides more detailed guidance to assist officers who are responsible for fraud and corruption control within entities to implement the requirements of the Rule and the Policy.

How the framework applies

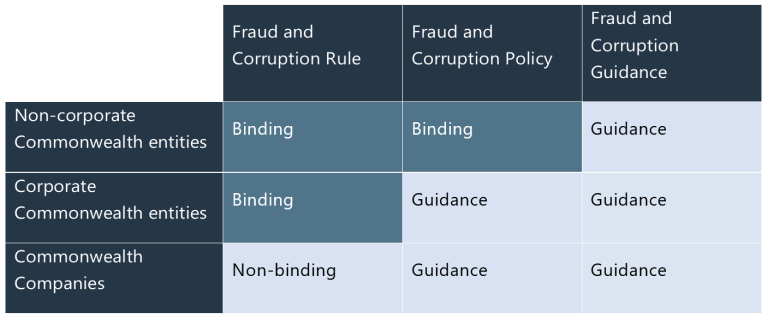

The 3 parts of the framework apply to different types of Commonwealth entities as follows:

While some parts of the framework are not mandatory for corporate Commonwealth entities (CCEs) and Commonwealth companies, these entities are strongly encouraged to implement all parts of the framework.

Overview of changes from the 2017 framework#

The changes form part of the Australian Government’s integrity reforms and align with new obligations of the National Anti-Corruption Commission.

The Fraud and Corruption Rule amendments align it with Australian Government policies including the Commonwealth Risk Management Policy and the Australian Government Investigation Standard, along with industry standards. This will strengthen the Commonwealth’s counter fraud and anti-corruption efforts.

The most significant change for the Fraud and Corruption Rule is that it now applies to corruption as well as fraud. This means accountable authorities of Commonwealth entities must take steps to prevent, detect and deal with corrupt conduct. This complements the National Anti-Corruption Commission’s prevention and investigation functions.

There are also new clauses requiring Commonwealth entities to:

- have governance structures and processes to effectively oversee and manage risks of fraud and corruption relating to them

- have officials who are responsible for managing risks of fraud and corruption relating to them

- periodically review the effectiveness of their fraud and corruption controls.

The following table provides a comparison between the key elements of the new Fraud and Corruption Rule, and the previous Fraud Rule.

| New Fraud and Corruption Rule (effective from 1 July 2024) | Comparison with the previous Fraud Rule (effective to 30 June 2024) |

|---|---|

| Entities must conduct fraud and corruption risk assessments regularly and when there is a substantial change in the structure, functions or activities of the entity | The Fraud Rule applied these requirements to fraud but not to corruption |

| Entities must develop and implement fraud and corruption control plans as soon as practicable after conducting a risk assessment | The Fraud Rule applied these requirements to fraud but not to corruption |

| Entities must periodically review the effectiveness of their fraud and corruption controls | There was no equivalent requirement in the Fraud Rule. However, the updated Commonwealth Risk Management Policy 2023 required entities to periodically review the effectiveness of controls since 1 January 2023 |

| Entities must have governance structures, processes and officials in place to oversee and manage fraud and corruption risks. Entities must keep records of those structures, processes and officials | There was no equivalent requirement in the Fraud Rule. However, the updated Commonwealth Risk Management Policy 2023 specifies governance requirements |

|

Entities must have appropriate mechanisms for preventing fraud and corruption by ensuring that:

|

The Fraud Rule applied these requirements to fraud but not to corruption |

|

Entities must have appropriate mechanisms for:

|

The Fraud Rule applied these requirements to fraud but not to corruption |

Additional resources#

Promotional toolkit

We have prepared this kit for Australian Government officials responsible for implementing fraud and corruption control measures to help promote the new framework. This kit contains:

- information about the new framework

- key messages for promoting the framework, the new changes and who this will affect

- communication products to support the promotion of the new framework, such as digital posters and screensavers, articles and PowerPoint slides.

To request a copy of the toolkit contact info@counterfraud.gov.au.

Information sheets

We have developed the following information sheets to help Commonwealth officials to understand and implement the new framework obligations.

Information Sheet – Element 1: Fraud and corruption risk assessments

How entities can better understand and document their exposure to fraud and corruption, the associated risks and existing control arrangements

Information Sheet – Element 2: Fraud and corruption control plans

How entities can document, communicate, manage and monitor activities that manage an entity’s identified fraud and corruption risks

Information Sheet – Element 3: Reviewing control effectiveness

How entities can ensure controls are designed correctly and operate effectively to reduce or manage risks

Information Sheet – Element 4: Governance and oversight

How entities can help entities enhance integrity, accountability and quality of outcomes through appropriate governance and oversight

Information Sheet – Element 5: Preventing fraud and corruption

Different strategies and mechanism that entities can employ to prevent fraud and corruption

Information Sheet – Element 6: Detecting fraud and corruption

Different mechanisms that entities can employ to detect fraud and corruption

Information Sheet – Element 7: Investigation and other responses

A range of actions entities can take to effectively respond to incidents of fraud and corruption

Information Sheet – Element 8: Recording and reporting fraud and corruption

How entities can record, report and share information about fraud and corruption and use the information strategically

Fraud and Corruption Capability Self Assessment Tool – New Release

We have developed the Fraud and Corruption Capability Self Assessment Tool to help Commonwealth entities assess their organisational capability to manage fraud and corruption risks. This aligns with paragraph 4.3 of the Commonwealth Fraud and Corruption Policy, which requires non-corporate Commonwealth entities to maintain an appropriate level of capability to effectively manage fraud and corruption risks.

View the Fraud and Corruption Capability Self Assessment Tool

Implementation roadmap

We have developed this roadmap to provide officials with an example of a step-by-step approach to implementing the new framework elements.

View the Implementation roadmap

Webinars and training

We hosted a series of webinars for Commonwealth officials in April and May 2024 about the new framework. To access webinar slides and recordings contact info@counterfraud.gov.au.

We offer a Counter Fraud Practitioner Training Program for Commonwealth officials engaged in fraud and corruption control. The training program consists of 5 full day interactive sessions on:

- Understanding and Communicating the Fraud Problem

- Fraud Risk Assessment

- Fraud Controls

- Data in Fraud Control and Fraud Control Assurance

- Fraud Control Investment.

To find out more or apply for upcoming training opportunities visit our Counter Fraud Practitioner Training Program page.

To find out more about broader government training opportunities, visit the National Training Register.